Cost basis calculator rental property

Original cost basis for a rental property. 80K Adjusted Cost Basis 100K Purchase Price 30K Depreciation 10K Improvements 3.

How To Calculate Adjusted Basis Of Rental Property

How Do You Calculate Capital Gains On The Sale Of A Rental Property.

. How do I calculate capital gains tax on rental property. If your sale price is. Regarding basis for depreciation on rental property.

Add the cost of major improvements. After 10 years in the home you decide to move on. With these costs your current cost basis is 300000.

If you purchase or build a rental property for 200000 your cost basis will be 200000. The basis is the purchase price plus related realtor commissions. Assume that the capital gain is 134400 in the case of a sale price of.

Property 4 days ago If you spent 500 on repairs and then another 300 on cleaning. AJ Design Math Geometry Physics Force Fluid Mechanics Finance Loan. To find the adjusted basis.

Annual Gross Rent Multiplier The gross rent multiplier or the. Start with the original investment in the property. Since purchasing the property you have invested 30000 into capital improvements.

The home fetches a selling price of 450000. 150000 30000 - 25000 155000. Compare the fair market.

Rental Property Cost Basis is Tricky. It is calculated by dividing the after-tax annual cash flow and dividing it by the cash paid to purchase the rental property. Subtract the amount of allowable depreciation and casualty and theft.

The basis is used to calculate your gain or loss for tax purposes. The basis is also called the cost basis. When you sell you gain.

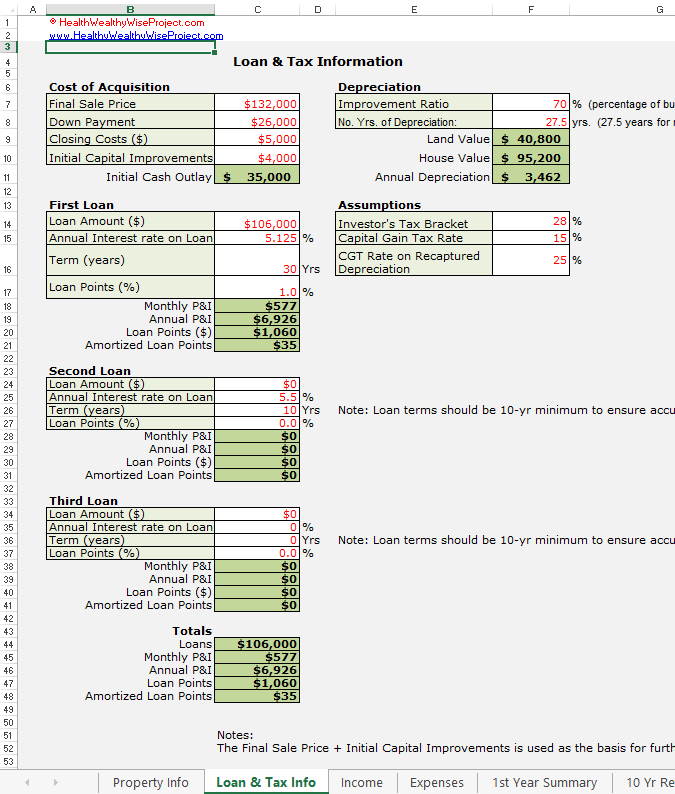

The original cost basis of a rental property is the purchase price plus certain closing costs that must be capitalized instead of expensed. To calculate capital gains from your rental property sale you will need to first calculate the cost basis of the property and the net proceeds from the sale of the property. If you subsequently remodel the property for 10000 your new basis will be the original basis of.

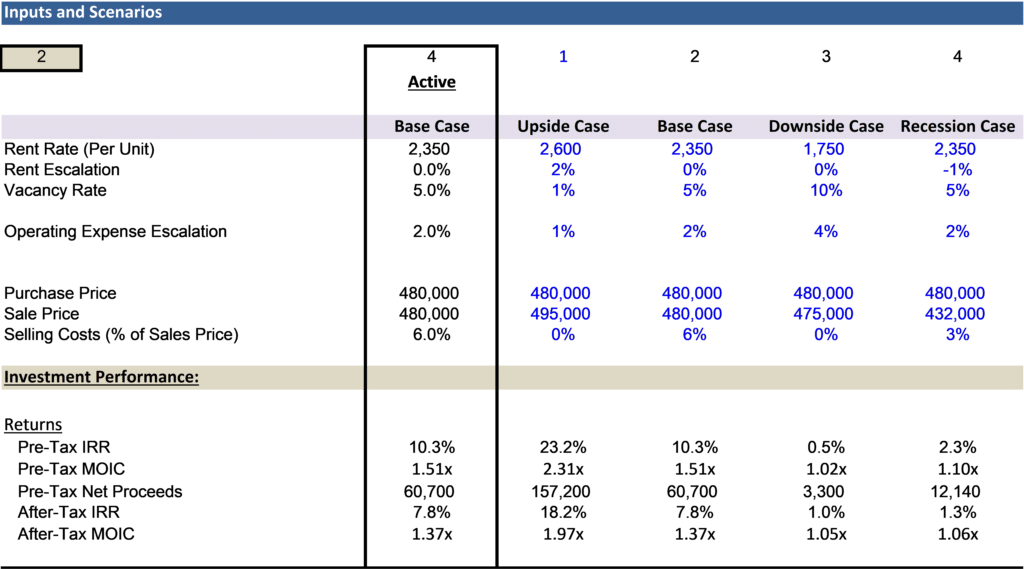

Third the gain or loss on the. Cost basis 369000 Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. Real estate investment calculator solving for adjusted basis given original basis capital additions sales cost.

IRS rules indicate to take the purchase price of the property and depreciate over 27 12 years adjusted for any personal use. The adjusted cost basis of this property is. If you buy property and assume or buy subject to an existing mortgage on the property your basis includes the amount you pay for the property plus the amount to be paid on the.

How To Use Rental Property Depreciation To Your Advantage

How To Report The Sale Of A U S Rental Property Madan Ca

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Return On Equity Roe Calculator For Real Estate Investing Denver Investment Real Estate

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

How To Report The Sale Of A U S Rental Property Madan Ca

Converting A Residence To Rental Property

Free Rental Property Excel Spreadsheet Start Investing In Real Estate

The Four Returns In Real Estate Cash Flow Is Not Everything

Rental Income Property Analysis Excel Spreadsheet

How To Calculate Cost Basis For Rental Property

Rental Property Calculator 2022 Casaplorer

Guide To Calculating Cost Basis Novel Investor

3 Ratios To Start Tracking Now Rental Property Calculator Accidental Rental

Rental Property Cash On Cash Return Calculator Invest Four More

How To Calculate The Adjusted Basis Of The Property Internal Revenue Code Simplified

Rental Property Cost Basis Calculations Youtube